Category Archives: Bookkeeping

Everything You Need to Know About the Income Statement

Content

Moving down the stairs from the net revenue line, there are several lines that represent various kinds of operating expenses. Although these lines can be reported in various orders, the next line after net revenues typically shows the costs of the sales. This number tells you the amount of money the company spent to produce the goods or services it law firm bookkeeping sold during the accounting period. The single-step format is useful for getting a snapshot of your company’s profitability, and not much else, which is why it’s not as common as the multi-step income statement. But if you’re looking for a super simple financial report to calculate your company’s financial performance, single-step is the way to go.

To prepare an income statement, small businesses must analyze and report their revenues, operating expenses, and the resulting gross profit or losses for a specific reporting period. The income statement, also called a profit and loss statement, is one of the major https://goodmenproject.com/business-ethics-2/navigating-law-firm-bookkeeping-exploring-industry-specific-insights/ financial statements issued by businesses, along with the balance sheet and cash flow statement. An income statement is one of the three important financial statements used for reporting a company’s financial performance over a specific accounting period.

How is a chart of accounts organized?

Based on their analysis, they can come up with the best solutions to yield more profit. Finally, using the drivers and assumptions prepared in the previous step, forecast future values for all the line items within the income statement. For example, for future gross profit, it is better to forecast COGS and revenue and subtract them from each other, rather than to forecast future gross profit directly.

Accountants, investors, and business owners regularly review income statements to understand how well a business is doing in relation to its expected future performance, and use that understanding to adjust their actions. A business owner whose company misses targets might, for example, pivot strategy to improve in the next quarter. Similarly, an investor might decide to sell an investment to buy into a company that’s meeting or exceeding its goals. To finalize your statement, add a header to the report identifying it as an income statement.

Chart of Accounts Sample

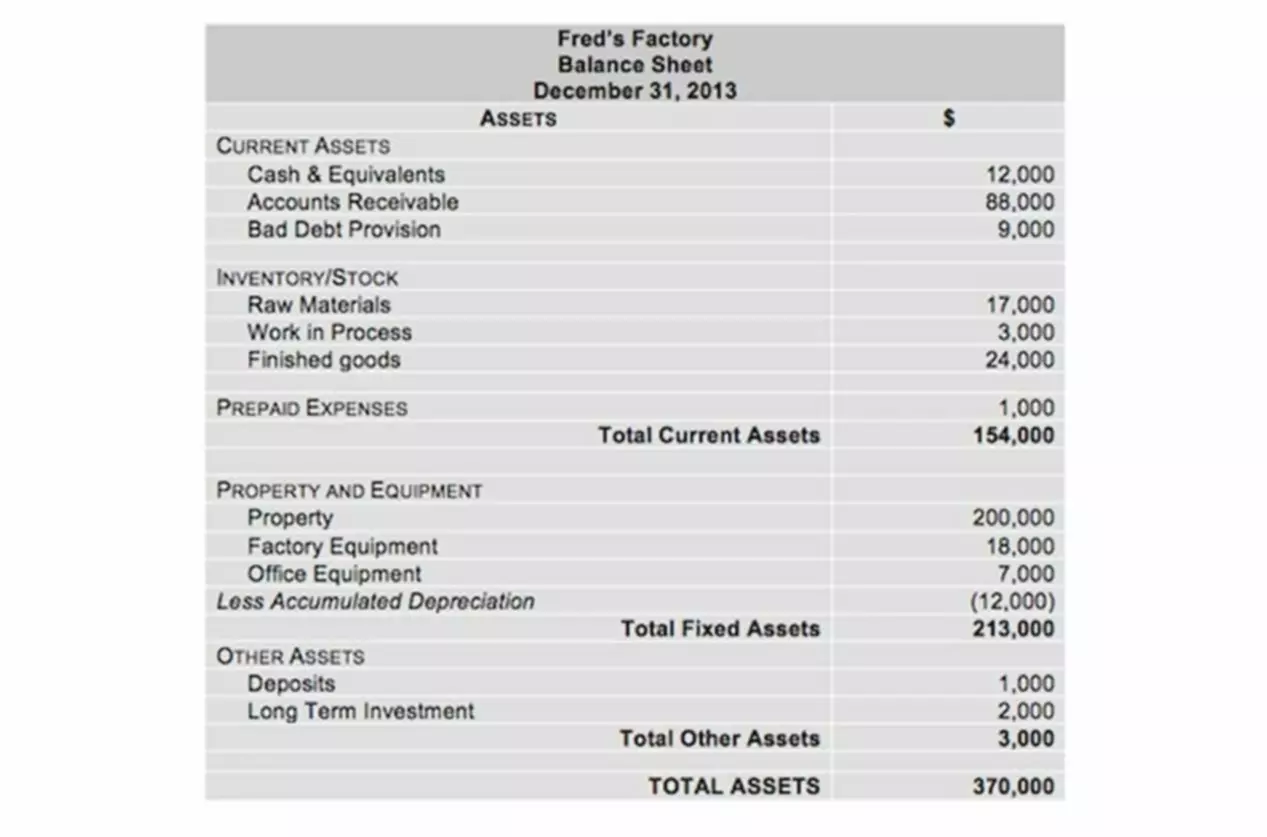

A balance sheet shows the financial position of the business at a specific point in time. The balance sheet is the cornerstone of a company’s financial statements, providing a snapshot of its financial position at a certain point in time. Download our FREE whitepaper on financial statements to dive into P&L statements, balance sheets, and cash flow statements. See examples, find out why you need financial statements, and so much more. An income statement is a report of your business’s profits and losses over a specific period.

- A chart of accounts gives you great insight into your business’s revenue beyond just telling you how much money you earn.

- It also includes account type definitions along with examples of the types of transactions or subaccounts each may include.

- We believe everyone should be able to make financial decisions with confidence.

- The income statement can help you determine if your business will generate revenue over the long haul.

- The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses.

The above example is the simplest form of income statement that any standard business can generate. It is called the single-step income statement as it is based on a simple calculation that sums up revenue and gains and subtracts expenses and losses. To create an income statement for your business, you’ll need to print out a standard trial balance report. You can quickly generate the trial balance through your cloud-based accounting software. Trial balance reports are internal documents that list the end balance of each account in the general ledger for a specific reporting period. It is a good idea to customize your COA to suit your business needs in a way that makes sense to you.Incorporating accounting software into your everyday business operations can only make organizing your accounts easier.

Investing Activities

An income statement helps business owners decide whether they can generate profit by increasing revenues, by decreasing costs, or both. It also shows the effectiveness of the strategies that the business set at the beginning of a financial period. The business owners can refer to this document to see if the strategies have paid off.

Gross profit is revenue less the cost of goods sold, and appears on the income statement after the costs of goods sold calculation. Income statements don’t differentiate cash and non-cash receipts or cash vs. non-cash payments and disbursements. EBITDA (earnings before interest, taxes, depreciation, and amortization) can be included but are not present on all P&Ls. FreshBooks provides free template income statements that are pre-formatted for your needs. All you need to do is fill in the empty fields with the numbers you’ve calculated. If you have found yourself struggling to find the time to create your own profit and loss report, or P&L, from scratch, a free invoice statement template is the perfect solution.

Free Financial Statements Cheat Sheet

Some businesses also include capital and financial statement categories. Used by businesses that sell tangible goods or have more than one line of business, the multistep income statement, as its name implies, uses multiple steps instead of one. With this type of income statement, the operating revenue and operating expenses are separated from the nonoperating revenue and nonoperating costs, losses and gains. Multi-step income statements separate operational revenues and expenses from non-operating ones. They’re a little more complicated but can be useful to get a better picture of how core business activities are driving profits.

Online Bookkeeping Services Virtual Bookkeeping Solutions

Content

Its basic plan is aimed at new companies that require online bookkeeping services. InDinero has its own accounting software, but you can also use it with QuickBooks Online. Bookkeepers and accountants both play a role in your business’s financial health, but business owners probably chat with their bookkeepers more frequently. Similar to competitors, Decimal offers additional features beyond bookkeeping services, like invoicing, bill pay and payroll. Unlike the competition, however, it also has add-ons for job costing and project-based accounting, which is a plus for businesses that need assistance gauging project profitability. Accounting software typically comes with project-tracking features, but analyzing the resulting figures can be time-consuming.

- A virtual bookkeeping company will have the tools to scale services as a company grows so that there is no disruption during a period of growth.

- We will set up the dashboards that are the most beneficial to your business.

- We specialize in eCommerce accounting and will help you stress less, save money, and protect and grow your business.

- The service doesn’t include financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll.

- Possible add-ons include payroll services, individual and business tax returns, and financial performance reporting with key performance indicators.

- When you have a Small Business Plus plan or higher, you get unlimited online support.

This service is ideal for business owners who want to get their bookkeeping in order but don’t have the time or resources to do it themselves. All bookkeeping services are based on a monthly subscription model. This is the best online bookkeeping services for small businesses that have tight budgets. We can also create a custom plan just for you to keep your average monthly expenses low. Bookkeepers would enter a company’s financial transactions after they had already happened.

What Are Online Bookkeeping Services?

This is especially true because small businesses may not have a full-time CFO or an in-house accounting department, but they still need to generate financial reports. They may hire a part-time bookkeeper to manage the day-to-day books, and they often use an external accounting firm for tax preparation. These tasks can be completed internally, or they can be farmed out as an external service.

How much can you make as a virtual bookkeeper?

$40,000 is the 25th percentile. Salaries below this are outliers. $56,000 is the 75th percentile.

Sunrise, by Lendio, used to be called Billy until it was acquired. It’s known for its easy-to-use interface and its simplification of accounting jargon. Bench is a popular small business choice because it’s What is the Difference Between Bookkeeping and Accounting an affordable bookkeeping service with an intuitive, easy-to-use platform. Bench gives you at-a-glance visual reports, which provide you with actionable insight that’ll help grow your small business.

Save time and money with a bookkeeping service.

Bench prides itself in being a simple, yet affordable online bookkeeping service for entrepreneurs. Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting https://adprun.net/what-to-expect-from-accounting-or-bookkeeping/ firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

- In-house teams use it to streamline their processes — data entry, bill payment, budget management, and more.

- Each service has its own features and solutions, so you’ll want to keep an eye on these things so that you can make the best decision for your business.

- This is why monthly accounting services are one of the best solutions for busy business owners.

- All the figures involved in your business ventures can be a challenge to keep track of.

We’ve analyzed the best bookkeeping services to help you find the right solution quickly and easily. We selected these services based on their service options, pricing, customer service, reputation and more. More so, you may not want to invest in an in-house professional because of budget limitations. If your company is struggling to balance the books and meet customer needs, it is time to reach out for our online bookkeeping services. Choose our remote bookkeeping services and experience the benefits of professional financial management tailored to your business. Contact us today for a free consultation and discover how we can help streamline your bookkeeping processes and drive your business forward.

Accounting and Bookkeeping

Content

Enjoy Saving Time and Money Get hands-on support from bookkeeping and tax planning experts who help save you time and offer you peace of mind.We dummy proof business bookkeeping. Our full service bookkeeping firm serves the needs of small to medium-size businesses, non-profits and individuals in the Austin and Houston, Texas metro areas. From on-site management to remote access, our team is ready to help take your business to the next level. We designed our reports with founders in mind.The highest compliment a business owner could give us is that our reports saved them time and money. We provide you with information that helps you from making million dollar mistakes.You will get all the reports that are necessary to make great decisions that improve your business. – Profit and Loss – Balance Sheet – Cash Flow StatementStart making decisions that affect next month’s bottom line.

Better Bookkeepers, Inc. is a full-service, independent bookkeeping firm with locations in The Woodlands and Georgetown, TX. We partner with medium and small businesses, non-profits and individuals throughout the Houston and Austin, TX metro areas. Our distinctive, boutique approach to bookkeeping services provides you with only what you need, saving you both time and money.

About Better Bookkeepers

We understand what CPAs need and what you as the business owner want to see to manage your business. Get a free consultation, and see why thousands of small business

owners trust Better Accounting with their books. We are located in The Woodlands and Georgetown serving clients throughout Texas at their offices or from ours. For more information on how we can help you with your bookkeeping needs, call or email us today. The Conroe/Lake Conroe Chamber is here for your business. Engage now to be a part of our community’s growth.

How can I make bookkeeping easier?

To make bookkeeping easier, many small business owners digitize their invoices, receipts, and bills. This keeps everything together and prevents problems caused by faded or lost receipts. You can also switch to digital receipts for sales transactions to ensure an accurate record for you and your clients.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Helping you focus on your business; leave the accounting to us. Please consult with a translator for accuracy if you are relying on the translation or are using this site for official business.

Better Bookkeepers Inc

We can then turn that over to you or provide one of our bookkeepers who will continue, as needed, “catch up” services to insure your books stay up to date and accurate. Better Accounting is a professional service for small businesses in need of help with their taxes, bookkeeping, and more. Our use of modern technology and year-round support makes us the perfect solution for all of your business accounting needs.It’s accounting, https://www.bookstime.com/articles/better-bookkeepers done better. Our bookkeeping professionals and tax accountants will work with you every step of the way, so you always have the financial clarity to make big decisions for your business. Beyond bookkeeping, we are the end to end tax and financial service for founders and soloprenuers. From expense classifications to tax filing and recommendations, we have you covered.Stop losing time and money and leave it to the pros.

How Do You Read a Balance Sheet?

Content

Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard. In this example, Apple’s total assets of $323.8 billion is segregated towards the top of the report. This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts.

Cash Equivalents are also lumped under this line item and include assets that have short-term maturities under three months or assets that the company can liquidate on short notice, such as marketable securities. Companies will generally disclose what equivalents it includes in the footnotes to the balance sheet. That’s because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity). Whatever a business owns — its assets — have been financed by either taking on debt (liabilities), or through investments from the owner or shareholders (equity). A company’s assets have to equal, or “balance,” the sum of its liabilities and shareholders’ equity. Liabilities also include obligations to provide goods or services to customers in the future.

Balance Sheet Templates

Integrate your Wise business account with Xero online accounting, and make it easier than ever to watch your company grow. Make a copy of this Google Sheets template and fill in your business details to create your own balance sheet in just a few simple steps. For example, in 2021, say a business’ assets increased by $15,000, from $235,000 to $250,000. Also in 2021, the same business paid off a loan, reducing its liabilities by $20,000, from $70,000 down to $50,000.

- Some companies issue preferred stock, which will be listed separately from common stock under this section.

- Private companies don’t need to file anything with the SEC but may still use balance sheets since they’re a simple way to look at a business’s financial standing at a point in time.

- A balance sheet explains the financial position of a company at a specific point in time.

- For federal income tax purposes, only C corporations are required to complete a balance sheet as part of their annual return.

- You’ve also taken $9,000 out of the business to pay yourself and you’ve left some profit in the bank.

It’s wise to have a buffer between your current assets and liabilities to cover your short-term financial obligations. Balance sheets give a quick overview of a company’s financial standing. A balance sheet is a financial statement that shows a company’s assets for a given period, such as a quarter or fiscal year.

How is the Balance Sheet used in Financial Modeling?

If a company’s assets are worth more than its liabilities, the result is positive net equity. If liabilities are larger than total net balance sheet basics assets, then shareholders’ equity will be negative. Shareholders’ equity is the initial amount of money invested in a business.

You may have omitted or duplicated assets, liabilities, or equity, or miscalculated your totals. If a company or organization is privately held by a single owner, then shareholders’ equity will generally be pretty straightforward. If it’s publicly held, this calculation may become more complicated depending on the various types of stock issued. Shareholders’ equity refers generally to the net worth of a company, and reflects the amount of money that would be left over if all assets were sold and liabilities paid. Shareholders’ equity belongs to the shareholders, whether they be private or public owners. Have you found yourself in the position of needing to prepare a balance sheet?

How to Read a Balance Sheet

Download our basic balance sheet template xls to get a snapshot of your company’s financials using Excel. In broad terms, owner’s equity is essentially what would be left for owners from company assets after paying off all liabilities. Designed with secondary or investment properties in mind, this comprehensive balance sheet template allows you to factor in all details relating to your investment property’s growth in value. You can easily factor in property costs, expenses, rental and taxable income, selling costs, and capital gains.

The best technique to analyze a balance sheet is through financial ratio analysis. With financial ratio analysis, you’ll use formulas to determine the financial health of the company. Because companies invest in assets to fulfill their mission, you must develop an intuitive understanding of what they are.

Limitations of a Balance Sheet

Without this knowledge, it can be challenging to understand the balance sheet and other financial documents that speak to a company’s health. When a balance sheet is reviewed externally by someone interested in a company, it’s designed to give insight into what resources are available to a business and how they were financed. Based on this information, potential investors can decide whether it would be wise to invest in a company. Similarly, it’s possible to leverage the information in a balance sheet to calculate important metrics, such as liquidity, profitability, and debt-to-equity ratio. As you can see from the balance sheet above, Walmart had a large cash position of $14.76 billion in 2022, and inventories valued at over $56.5 billion. This reflects the fact that Walmart is a big-box retailer with its many stores and online fulfillment centers stocked with thousands of items ready for sale.

What Are the Three Bank Accounts Every Law Firm Should Have?

Content

An income or operating statement is a financial statement that shows a company’s income and expenses. The income statement reflects whether a law firm is making a profit or loss over a period. You can understand the financial health of your practice through the income statement (together with the balance sheet and cash flow statement). When it comes to banking, it is essential to find a bank and a banker with experience working with law firms, especially if your state or practice requires trust accounts. Be sure to do your due diligence and avoid banking headaches by developing a strong and beneficial relationship with a personal banker.

Any money that your business holds onto for a client and hasn’t earned goes into a client trust account (CTA). Recording any money still in a trust account as income is a glaring error and is also against the rules. You may count funds in trust accounts as income until you have earned fees for services rendered.

Best practices in law firm bookkeeping

They’ll be more familiar with the ins and outs of law firm accounting, including the rules and regulations that could get you into trouble. To do this, legal accountants capture expenses, provide financial forecasting, and prepare financial statements. A legal accountant and bookkeeper will work towards the same goal — they both want to keep your law firm financially healthy and built for the future. But the way they go about it is different, doing different tasks for the good of your law firm. That’s why we’ve put together everything you need to know about law firm accounting and bookkeeping. Have you ever tried to balance your checkbook, only to find you’re a quarter off somewhere?

What’s most important is that you get the details right so that you can stay compliant with ethics rules and help your firm grow to its full potential. You can’t use Excel spreadsheets to maintain all of your financial books and records for an entire year. When used for that much data, Excel becomes clunky and lacks features you could use to improve your reporting. Accrual accounting records revenues and expenses when earned and incurred, regardless of when the money is received or paid. For example, when you send an invoice to a client, you’ll mark it as revenue, even though you might not get paid for 30 days.

Communicate with the attorney

Unless the IRS requires you to use the accrual method—for law firms, this rule only kicks in once you start making $10m a year—which method is best will depend on your accounting needs. Accrual accounting records revenues and expenses when they are earned and incurred, regardless of when the money is actually received or paid. For example, when you send an invoice to a client, you’ll mark it as revenue, even though you might not get paid for 30 days. Cash accounting recognizes revenues when cash is received, and expenses when they are paid.

- The expenses are not income, so they need to get logged separately.

- Your firm needs to keep track of your invoices so you know what money is owed (and who you owe money to) to avoid this problem.

- You should consult your bank, state bar association, and CPA to determine what kind of payments your firm will accept.

- To effectively manage legal accounting for law firms, it’s wise to start with a foundation that works for all aspects of running your firm.

- Many business owners think that they will hire an accountant but not a bookkeeper.

- As a lawyer, when you receive cash that belongs to a client, you are obligated to hold those funds in a client trust account separate from your own money.

That’s why it’s important to take your time, double-checking your entries as you go. We know that lazy bookkeeping practices will cost you real money and time, result in sweaty nightmares, and put your license and firm at risk. Thankfully, good bookkeeping can also result in accurate reports on demand, make billing easier and improve the way you view your finances.

Open the three main accounts

Once you develop a bookkeeping system, around tax time business owners will want to consider working a CPA or professional tax accountant to handle your tax returns. While there are some outsourced services that offer this functionality, so far I’ve found that working with individuals and small accounting firms is better for this task. Here’s the list of tax accountants that we’ve vetted at the Biglaw Investor. When you take funds out of your business for personal use, it can either be classified as a capital withdrawal or as a payment for salary. These are two different types of transactions and need to be managed accordingly. Having a bookkeeping and accounting system in place will ensure that the payments to yourself are recorded appropriately as salary.

Lastly, transactions are not recorded until you receive the money, so it’s not taxed until it’s actually in the bank. When you have a trust account, you’re required (by the State Bar) to perform a three-way trust reconciliation law firm bookkeeping every 30 to 90 days. To do so, you’d first need to transfer that money into your business account. Instead, employ good accounting and budgeting practices, so you don’t need to dip into these fees in the first place.

Accelerating deductions with payroll tax accruals

Content

Payroll accounting encompasses every required law and regulation to promote compliance. The accrual entries have a general ledger date that is equal to the end of the prior accounting period. The Reference Number is equal to the journal type plus the original general ledger date. In a transition period situation, it may be beneficial to have expenses distributed between the two fiscal periods. This is particularly beneficial when all the timecards within a transition pay period are dated with the pay period end date, which, in this example, would be May 9th.

What is the journal entry for payroll taxes?

The primary payroll journal entry is for the initial recordation of a payroll. This entry records the gross wages earned by employees, as well as all withholdings from their pay, and any additional taxes owed to the government by the company.

Next, add the amount that you contribute to your employee’s health insurance premiums. Usually, this amount is split between an employer and employee, so be sure to account for only your portion of this cost. In addition, if you include a retirement contribution matching program for employees’ 401(k) accounts, then the amount that you contribute will be included during this step in the calculation too. If any bonuses, cash prizes, or commissions were awarded to employees immediately, then these will not be counted in accrued payroll.

How to Accrue Payroll for Your Small Business

The employer withholds income tax amounts based on the allowances designated by each employee and tax tables provided by the government. The employer pays these withheld amounts to the Internal Revenue Service (IRS). In addition to income taxes, FICA requires a deduction from employees’ pay for federal social security and Medicare benefits programs. FICA taxes are withheld by the employer and are deposited along with federal income taxes in a financial institution. Even a cash primary business can deduct payroll taxes on payroll days. The accrued payroll taxes should match what you will pay when due to taxing authorities, particularly the IRS.

Nanonets accounting automation software can automate manual processes like reimbursements, data entry, general ledger coding, payment reconciliation, and more. Train your employees on how to use the system, how to submit their expenses and their documents to ensure error-free payroll processing. You can ask employees to use OCR software, receipt scanner apps, or OCR extension to extract data from their documents on the go. Most accounting automation software comes with workflow automation as a feature. You can use them to set up proper rules to ensure your tax calculations, PTO calculations, bonus, etc comply with your company policies. After entering the journal entries, you must post them to the general ledger.

How is payroll accounting done?

Every time you run payroll for your business, you are responsible for withholding FICA taxes, unemployment taxes, and other forms of employment taxes. The process described for sales taxes works the same for each of these payroll tax payable accounts. When the payroll is run, the payroll taxes are entered into the accounting software as accrued liabilities.

Accrued taxes are also listed as liabilities on the company’s books. Your business balance sheet records your business assets on one side, and on the other side, the balance sheet shows liabilities and owner’s accrued payroll equity. The accrued liabilities are included on the right side of the balance sheet. Short-term accrued liabilities (those expected to be paid in less than a year) are shown before long-term liabilities.

How to Calculate Tax Payable on the Balance Sheet

Again, add the calculated amounts to the gross wages, bonuses and overtime pay. In addition, the term accrued payroll can also refer to an accounting method which is used to track and record outstanding payroll expenses for better cost control and budgeting. In other words, payroll accrual is the process during which you add up all your payroll liabilities. The payroll liability account is considered a credit on the balance sheet.

Sean Butner has been writing news articles, blog entries and feature pieces since 2005. His articles have appeared on the cover of “The Richland Sandstorm” and “The Palimpsest Files.” He is completing graduate coursework in accounting through Texas A&M University-Commerce. He currently advises families on their insurance and financial planning needs.

Accrued Payroll Tax Liability Is Deductible Even If Compensation Is Deferred Under Sec. 404

Uses of profits are reflected as asset accounts at the top of the balance sheet. You may also have liabilities accounts representing borrowing to acquire some of the assets. The result is that the balancing equation in double-entry bookkeeping is assets equal liabilities plus equity. Employee FICA tax on this amount is $5,737.50, and employees have opted to have income tax withholdings of $3,680.

Businesses that offer employees defined vacation and sick time need to track how much they’d walk away with if they left the company. With every payroll accrual, update how much your employee earned in vacation and sick time. All accrued expenses are liabilities on your balance sheet until they’re paid.

How Do You Choose the Right General Ledger Architecture to Scale?

Content

Over the lifetime of a payment transaction, about 50 rows have to be inserted into the accounting database. This means that per second, just for the accounting system, the amount of inserts is an order of magnitude higher than the hundreds of transactions we process every second. Some time ago these thousands of inserts a second started to cause issues for our PostgreSQL database.This blog has more information on maintaining such large PostgreSQL databases. We are honored to be awarded for Highest User Adoption by G2 in the Project-Based ERP software category by professional services firms. In addition, Deltek Ajera is recognized with the Users Love Us badge, based on customer reviews. Today was the 22nd installment of #ArchiTalks – a blogging event with other architects where I provide a word or concept and let them interpret it however they want.

Bonsai Tax is reliable accounting software designed specifically for architects, freelancers, and self-employed workers. It allows them to automate and track expenses, create and send invoices, make or receive payments, and estimate taxes. An Accounting and project management software like Bonsai ensures that architects are on top of their company finances by tracking expenses and providing income reports, tax reminders, and lots more. Candace is the owner and head virtual bookkeeper at The Builders’ Keep LLC, virtual bookkeeping for master builders! In 2007, she graduated from the University of Central Florida with a BSBA in business management. As a fellow creative mind, (singer/songwriter) she understands the architect’s desire to simply create without the stresses of business undermining creation.

What Architects Do Everyday? (Explained)

“I enjoy the creative freedom that competitions give, as well as the diverse range of settings and scenarios that competitions can expose me to.” “As we are at the very beginning of our architectural journey, we wanted to face a real competition task on our own. We want to provoke discussions on topics important to us in architecture and society. Thanks to competitions, we can reach a larger group of recipients.” “Architecture competitions like this allow me to think about projects that are grounded within tangible limitations and affordances. They are good opportunities to test out ideas and methods I have acquired during my studies.” “Architectural competitions allow you to expand your exposure to different scales and typologies of use. Competitions provide an opportunity to let your creative side out while working through new and unfamiliar challenges.” “Architecture competitions are a way to challenge ourselves with problems that are far from our surroundings. It is a way to gather knowledge about problems all around the world, get educated about different cultures, history and ways of life. We are constantly seeking intriguing briefs from all around the world in order to further augment our academic development.” “Competitions are a different way of learning and exploring architecture. What I learn from my own project and from other projects can be my biggest motivation when not only the process, but also the results are released.”

- “It is an opportunity to challenge ourselves and think in unconventional ways, working with other themes, settings, and frames than what our common projects provide. It is not every day we are asked to design dwellings for bats for example.”

- “Competitions could be a fascinating glimpse of being passionate, creative, experimental, more serious, and be desperate on something that you really care about. You don’t have to struggle with bureaucracy, budget, or worry being political means.”

- “Competitions are a great way to challenge the norms of the industry and design freely again without the formal restrictions that we have become a little too familiar with.”

- “I like to think of myself as a creative person and I need to create things. Participating in architecture vision competitions allows me to explore the productive side of my personality. It’s inspiring and stimulating.”

- Even a small firm can be responsible for large projects involving substantial amounts of money.

- “Architecture competitions are important to challenge our architecture to be more than practical and they give us a better view on the builded society in the future.”

“Competitions always allow you to see many different perspectives on one task. You can see many different ideas that you have not considered yourself and are always a great source of inspiration and new experience.” “It was an interesting and challenging exercise where we had the chance to combine our different experiences in a joint project.” Van Duysen’s style is one that focuses on functionality, durability, and comfort, and is not shy of aesthetics, but resist fashion and trends. His Instagram feed is therefore full of stunning images of architecture, as well as fine artworks, travel, and more than a few of his dog Gaston.

Zaha Hadid Architects

If you have an architectural firm, finding a professional with the experience you’re looking for is vital to the growth and continued success of your business. To learn more about all the ways a CPA for architects can help you, or to schedule an initial consultation, contact us today. You may be struggling with misplaced invoices, disorganized records, and incomplete tax data. If your financial records are a mess, you’ll find yourself searching for outsourced accounting services for your architecture firm sooner or later.

Architects often must accept full and unlimited liability for the integrity and viability of a particular structure, since human lives, and comfort, depend on it. That’s why architects seek Lohn Caulder to help them deal with the details and protect their accumulating wealth as efficiently as possible. law firm bookkeeping During your initial consultation, make it clear which services you require and request a quote. If you have a budget in mind, mention that too and see if they are willing to work with you. Unfortunately, there are no hard and fast pricing rules when it comes to hiring a professional CPA.

Deltek Ajera: Project Management and Accounting Software

The Payment Processing Layer (or PAL, see part one) saves the payment in a local database and a separate process picks it up when possible. This process will run behind if we have doubt about whether we can guarantee consistency in the accounting or if an accounting database is not available but that will not impact the availability of the PAL itself. An added benefit of this setup is that if the PAL crashes, no payments are lost because the queue is stored in a database and not in memory. Historically, processes such as our back office (admin area) would interface directly with the accounting databases to display data or to make corrections.

- “To keep our edge. Speculative design helps architects and urbanists to question “norms.” Together, through the crucible of vision competitions, we can explore break-throughs ideas for not just for architecture and design, but also for policy, place, and living.”

- From pre-design to construction administration, your tasks and responsibilities are great.

- Candace is the owner and head virtual bookkeeper at The Builders’ Keep LLC, virtual bookkeeping for master builders!

- “Architecture competitions are an opportunity to put into practice the knowledge that arises from academic research.”

- “Architecture design competitions are a wonderful way of communicating your ideas and visions to a larger audience. For a small team from a small developing country like ours, it is very difficult to reach out to a larger audience by any other means.”

- “Competition projects serve as the perfect laboratory for us to imagine and test new ideas, serving various purposes. For the organizer/initiator of the competition, we strive to present a different, unique, yet always fitting and realistic idea to address the challenges of the design brief.”

You depend on accurate, trustworthy information about your firm’s financial strength to make informed, well-founded decisions. Our assurance professionals take a proactive approach that includes candid and open communication to address your financial reporting needs. Our independence and objectivity help deliver the security and confidence you expect. Very few platforms offer options to switch between a fused and subledger architecture.