Monthly Archives: noviembre 2020

Accounting and Bookkeeping

Content

Enjoy Saving Time and Money Get hands-on support from bookkeeping and tax planning experts who help save you time and offer you peace of mind.We dummy proof business bookkeeping. Our full service bookkeeping firm serves the needs of small to medium-size businesses, non-profits and individuals in the Austin and Houston, Texas metro areas. From on-site management to remote access, our team is ready to help take your business to the next level. We designed our reports with founders in mind.The highest compliment a business owner could give us is that our reports saved them time and money. We provide you with information that helps you from making million dollar mistakes.You will get all the reports that are necessary to make great decisions that improve your business. – Profit and Loss – Balance Sheet – Cash Flow StatementStart making decisions that affect next month’s bottom line.

Better Bookkeepers, Inc. is a full-service, independent bookkeeping firm with locations in The Woodlands and Georgetown, TX. We partner with medium and small businesses, non-profits and individuals throughout the Houston and Austin, TX metro areas. Our distinctive, boutique approach to bookkeeping services provides you with only what you need, saving you both time and money.

About Better Bookkeepers

We understand what CPAs need and what you as the business owner want to see to manage your business. Get a free consultation, and see why thousands of small business

owners trust Better Accounting with their books. We are located in The Woodlands and Georgetown serving clients throughout Texas at their offices or from ours. For more information on how we can help you with your bookkeeping needs, call or email us today. The Conroe/Lake Conroe Chamber is here for your business. Engage now to be a part of our community’s growth.

How can I make bookkeeping easier?

To make bookkeeping easier, many small business owners digitize their invoices, receipts, and bills. This keeps everything together and prevents problems caused by faded or lost receipts. You can also switch to digital receipts for sales transactions to ensure an accurate record for you and your clients.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Helping you focus on your business; leave the accounting to us. Please consult with a translator for accuracy if you are relying on the translation or are using this site for official business.

Better Bookkeepers Inc

We can then turn that over to you or provide one of our bookkeepers who will continue, as needed, “catch up” services to insure your books stay up to date and accurate. Better Accounting is a professional service for small businesses in need of help with their taxes, bookkeeping, and more. Our use of modern technology and year-round support makes us the perfect solution for all of your business accounting needs.It’s accounting, https://www.bookstime.com/articles/better-bookkeepers done better. Our bookkeeping professionals and tax accountants will work with you every step of the way, so you always have the financial clarity to make big decisions for your business. Beyond bookkeeping, we are the end to end tax and financial service for founders and soloprenuers. From expense classifications to tax filing and recommendations, we have you covered.Stop losing time and money and leave it to the pros.

Inscripciones abiertas a Mesas Previas

Inscripciones Ciclo 2021

Familias, desde la EETP 602 queremos informarles que a partir del lunes 16/11/2020 hasta el 14/12/2020 estará abierta la inscripción para ingresantes a 1er año. Dicha inscripción se realizará online sin entrega de documentación física por el momento.

En caso de no poder realizarla deben dirigirse a la escuela primaria de origen. El sorteo de vacantes se realizará el 15/12/2020.

Infografia: Prevención Grooming

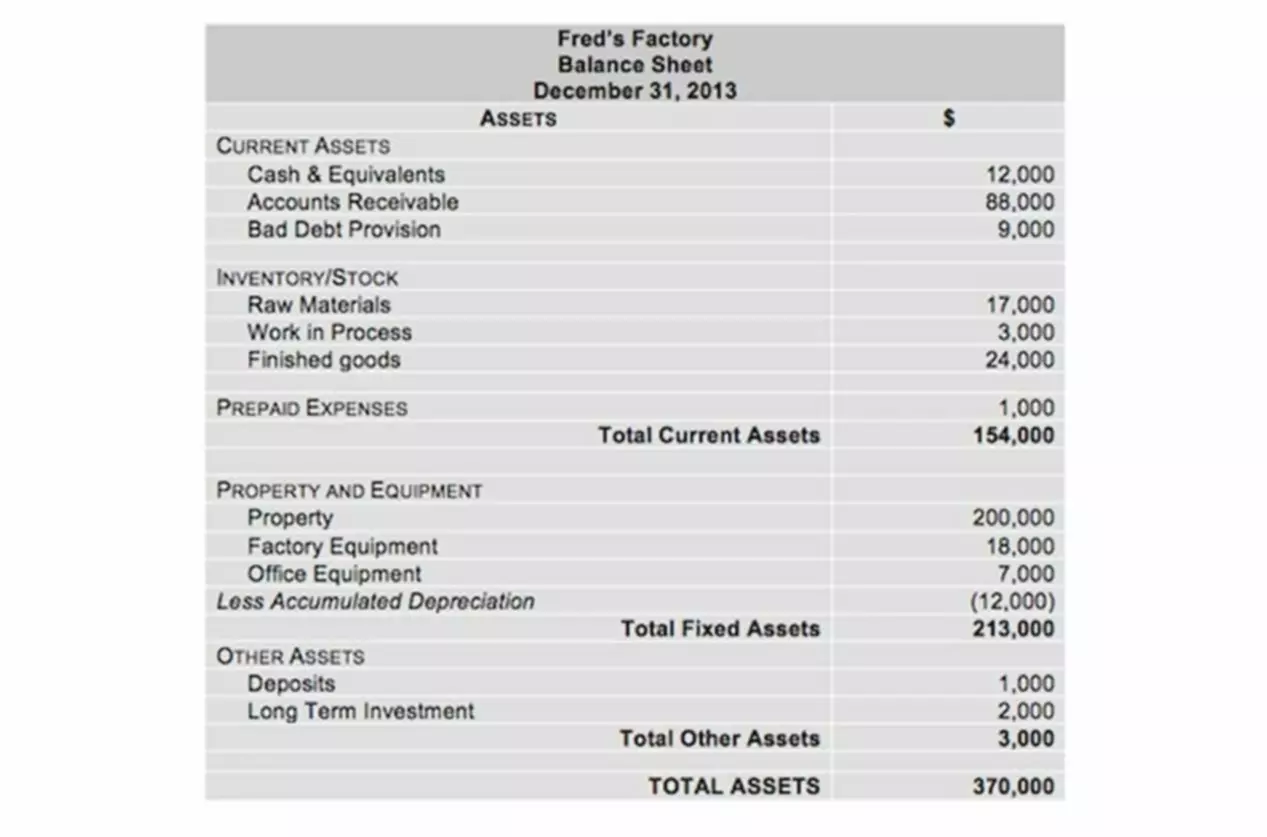

How Do You Read a Balance Sheet?

Content

Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard. In this example, Apple’s total assets of $323.8 billion is segregated towards the top of the report. This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts.

Cash Equivalents are also lumped under this line item and include assets that have short-term maturities under three months or assets that the company can liquidate on short notice, such as marketable securities. Companies will generally disclose what equivalents it includes in the footnotes to the balance sheet. That’s because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity). Whatever a business owns — its assets — have been financed by either taking on debt (liabilities), or through investments from the owner or shareholders (equity). A company’s assets have to equal, or “balance,” the sum of its liabilities and shareholders’ equity. Liabilities also include obligations to provide goods or services to customers in the future.

Balance Sheet Templates

Integrate your Wise business account with Xero online accounting, and make it easier than ever to watch your company grow. Make a copy of this Google Sheets template and fill in your business details to create your own balance sheet in just a few simple steps. For example, in 2021, say a business’ assets increased by $15,000, from $235,000 to $250,000. Also in 2021, the same business paid off a loan, reducing its liabilities by $20,000, from $70,000 down to $50,000.

- Some companies issue preferred stock, which will be listed separately from common stock under this section.

- Private companies don’t need to file anything with the SEC but may still use balance sheets since they’re a simple way to look at a business’s financial standing at a point in time.

- A balance sheet explains the financial position of a company at a specific point in time.

- For federal income tax purposes, only C corporations are required to complete a balance sheet as part of their annual return.

- You’ve also taken $9,000 out of the business to pay yourself and you’ve left some profit in the bank.

It’s wise to have a buffer between your current assets and liabilities to cover your short-term financial obligations. Balance sheets give a quick overview of a company’s financial standing. A balance sheet is a financial statement that shows a company’s assets for a given period, such as a quarter or fiscal year.

How is the Balance Sheet used in Financial Modeling?

If a company’s assets are worth more than its liabilities, the result is positive net equity. If liabilities are larger than total net balance sheet basics assets, then shareholders’ equity will be negative. Shareholders’ equity is the initial amount of money invested in a business.

You may have omitted or duplicated assets, liabilities, or equity, or miscalculated your totals. If a company or organization is privately held by a single owner, then shareholders’ equity will generally be pretty straightforward. If it’s publicly held, this calculation may become more complicated depending on the various types of stock issued. Shareholders’ equity refers generally to the net worth of a company, and reflects the amount of money that would be left over if all assets were sold and liabilities paid. Shareholders’ equity belongs to the shareholders, whether they be private or public owners. Have you found yourself in the position of needing to prepare a balance sheet?

How to Read a Balance Sheet

Download our basic balance sheet template xls to get a snapshot of your company’s financials using Excel. In broad terms, owner’s equity is essentially what would be left for owners from company assets after paying off all liabilities. Designed with secondary or investment properties in mind, this comprehensive balance sheet template allows you to factor in all details relating to your investment property’s growth in value. You can easily factor in property costs, expenses, rental and taxable income, selling costs, and capital gains.

The best technique to analyze a balance sheet is through financial ratio analysis. With financial ratio analysis, you’ll use formulas to determine the financial health of the company. Because companies invest in assets to fulfill their mission, you must develop an intuitive understanding of what they are.

Limitations of a Balance Sheet

Without this knowledge, it can be challenging to understand the balance sheet and other financial documents that speak to a company’s health. When a balance sheet is reviewed externally by someone interested in a company, it’s designed to give insight into what resources are available to a business and how they were financed. Based on this information, potential investors can decide whether it would be wise to invest in a company. Similarly, it’s possible to leverage the information in a balance sheet to calculate important metrics, such as liquidity, profitability, and debt-to-equity ratio. As you can see from the balance sheet above, Walmart had a large cash position of $14.76 billion in 2022, and inventories valued at over $56.5 billion. This reflects the fact that Walmart is a big-box retailer with its many stores and online fulfillment centers stocked with thousands of items ready for sale.