Monthly Archives: septiembre 2020

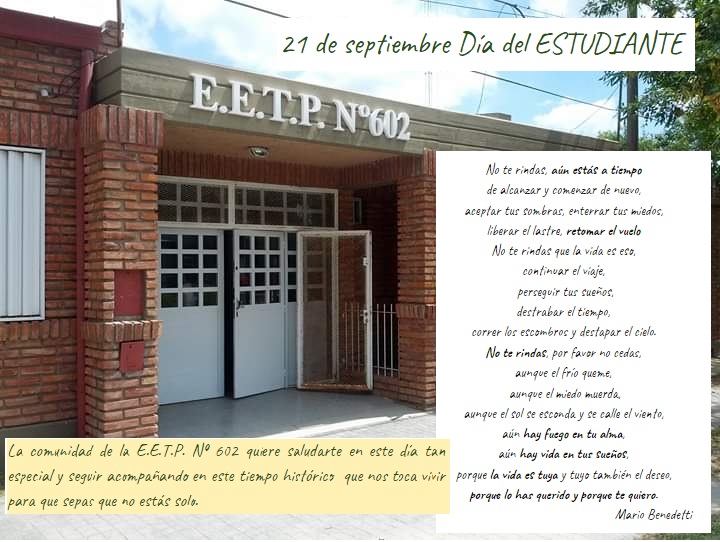

¡Feliz Día del ESTUDIANTE!

Primavera cuidada

Buen día alumnos!! Se que es domingo, pero anoche me fui a dormir pensando en que me gustaría escribirles algo, necesito que podamos hablar un rato, aunque sea de esta forma virtual como estamos acostumbrados en esta época.

Recuerdo el festejo de las primaveras en mi época de secundaria, las salidas con amigas a tomar mates a la plaza, a festejar cumpleaños de 15, salir a dar vueltas en bicicleta o en moto, ni hablar si un amigo tenía auto.

Accelerating deductions with payroll tax accruals

Content

Payroll accounting encompasses every required law and regulation to promote compliance. The accrual entries have a general ledger date that is equal to the end of the prior accounting period. The Reference Number is equal to the journal type plus the original general ledger date. In a transition period situation, it may be beneficial to have expenses distributed between the two fiscal periods. This is particularly beneficial when all the timecards within a transition pay period are dated with the pay period end date, which, in this example, would be May 9th.

What is the journal entry for payroll taxes?

The primary payroll journal entry is for the initial recordation of a payroll. This entry records the gross wages earned by employees, as well as all withholdings from their pay, and any additional taxes owed to the government by the company.

Next, add the amount that you contribute to your employee’s health insurance premiums. Usually, this amount is split between an employer and employee, so be sure to account for only your portion of this cost. In addition, if you include a retirement contribution matching program for employees’ 401(k) accounts, then the amount that you contribute will be included during this step in the calculation too. If any bonuses, cash prizes, or commissions were awarded to employees immediately, then these will not be counted in accrued payroll.

How to Accrue Payroll for Your Small Business

The employer withholds income tax amounts based on the allowances designated by each employee and tax tables provided by the government. The employer pays these withheld amounts to the Internal Revenue Service (IRS). In addition to income taxes, FICA requires a deduction from employees’ pay for federal social security and Medicare benefits programs. FICA taxes are withheld by the employer and are deposited along with federal income taxes in a financial institution. Even a cash primary business can deduct payroll taxes on payroll days. The accrued payroll taxes should match what you will pay when due to taxing authorities, particularly the IRS.

Nanonets accounting automation software can automate manual processes like reimbursements, data entry, general ledger coding, payment reconciliation, and more. Train your employees on how to use the system, how to submit their expenses and their documents to ensure error-free payroll processing. You can ask employees to use OCR software, receipt scanner apps, or OCR extension to extract data from their documents on the go. Most accounting automation software comes with workflow automation as a feature. You can use them to set up proper rules to ensure your tax calculations, PTO calculations, bonus, etc comply with your company policies. After entering the journal entries, you must post them to the general ledger.

How is payroll accounting done?

Every time you run payroll for your business, you are responsible for withholding FICA taxes, unemployment taxes, and other forms of employment taxes. The process described for sales taxes works the same for each of these payroll tax payable accounts. When the payroll is run, the payroll taxes are entered into the accounting software as accrued liabilities.

Accrued taxes are also listed as liabilities on the company’s books. Your business balance sheet records your business assets on one side, and on the other side, the balance sheet shows liabilities and owner’s accrued payroll equity. The accrued liabilities are included on the right side of the balance sheet. Short-term accrued liabilities (those expected to be paid in less than a year) are shown before long-term liabilities.

How to Calculate Tax Payable on the Balance Sheet

Again, add the calculated amounts to the gross wages, bonuses and overtime pay. In addition, the term accrued payroll can also refer to an accounting method which is used to track and record outstanding payroll expenses for better cost control and budgeting. In other words, payroll accrual is the process during which you add up all your payroll liabilities. The payroll liability account is considered a credit on the balance sheet.

Sean Butner has been writing news articles, blog entries and feature pieces since 2005. His articles have appeared on the cover of “The Richland Sandstorm” and “The Palimpsest Files.” He is completing graduate coursework in accounting through Texas A&M University-Commerce. He currently advises families on their insurance and financial planning needs.

Accrued Payroll Tax Liability Is Deductible Even If Compensation Is Deferred Under Sec. 404

Uses of profits are reflected as asset accounts at the top of the balance sheet. You may also have liabilities accounts representing borrowing to acquire some of the assets. The result is that the balancing equation in double-entry bookkeeping is assets equal liabilities plus equity. Employee FICA tax on this amount is $5,737.50, and employees have opted to have income tax withholdings of $3,680.

Businesses that offer employees defined vacation and sick time need to track how much they’d walk away with if they left the company. With every payroll accrual, update how much your employee earned in vacation and sick time. All accrued expenses are liabilities on your balance sheet until they’re paid.

Primavera 2020 con la EETP N°602

Inscripción Mesas de examen Octubre

Informamos que se encuentra abierta la inscripción a las mesas de exámenes instancia octubre que se llevarán a cabo los días 26 – 27 – 28 de ese mes.

El periodo de inscripción será desde el 17-9-2020 hasta el 2-10-2020. Para inscribirse deben completar el siguiente formulario con los datos actualizados.

Una vez que cierre el periodo de inscripción los docentes se contactaran con los estudiantes para acordar el método de trabajo y evaluación.

Drug and Alcohol Treatment Center

Content

A person feels a strong need, desire, or urge to use alcohol or drugs, continues using alcohol or a drug despite negative consequences, and feels anxious and irritable if he or she can’t use them. A person needs increasingly larger amounts of alcohol or drugs to get high. Every day in America, 114 people die as a result of drug overdose, and 205 more die as a result of alcohol abuse. Behavioral contracting or contingency management uses a set of

predetermined rewards and punishments established by the therapist and patient

(and significant others) to reinforce desired behaviors. Effective use of this

technique requires that the rewards and punishments, or contingencies, be

meaningful, that the contract be mutually developed, and that the contingencies be

applied as specified. Some studies suggest that positive contingencies are more

effective than negative ones (National

Institute on Drug Abuse, unpublished).

- By participating in treatment while still being present for other areas of life, treatment and recovery are less stigmatizing.

- Our leading recovery staff is comprised of some of the most dedicated, compassionate, and understanding addiction treatment specialists in the industry.

- While alcohol abuse and addiction is difficult to overcome, it can be done with the help of a quality alcohol addiction treatment center or hospital.

In addition to professionally led treatment, many people benefit from mutual support groups. Groups can vary widely, so it’s important to try different ones to find a good fit. This combination can mirror the “active ingredients” of the best specialty programs. At the same time, it’s a way to get higher quality, one-on-one care that maintains privacy. People often think there are only two places to get help for alcohol problems—Alcoholics Anonymous (AA) or residential rehab.

Honoring National PTSD Awareness Day at Banyan

Here’s a quick self-assessment quiz you can take to get a better idea of your situation. Addiction treatment is probably a whole new world to you, but rehab and recovery are what we’re all about. If you don’t have insurance, contact us to inquire about alternative methods regarding treatment for yourself or a loved one. Find a Blue Distinction treatment facility using our Provider Directory.

As an independent drug and alcohol treatment center, our caring recovery staff members make decisions on patient care in-house. You are given the best chance of recovery knowing that your best interests are always at the forefront of our decisions. The Rehabilitative Services Division provides comprehensive residential and outpatient treatment to adults diagnosed with substance use disorders who currently reside in Miami-Dade County. Services are provided through assessment, intervention, direct treatment, case management and referral.

How to Recognize Emotional Abuse vs. Mental Abuse

Important differences in language persist between public and private

sector programs and, to a lesser extent, in treatment efforts originally developed

and targeted to persons with alcohol- as opposed to illicit drug-related problems. Programs are increasingly trying to meet individual needs and to tailor the program

to the patients rather than having a single standard format with a fixed length of

stay or sequence of specified services. Harbor Light Center is accredited by the Commission on Accreditation of Rehabilitation Facilities (CARF). Treatment options vary based on facility, with inpatient, outpatient, and detox services available. The largest center is located in The Salvation Army Freedom Center in Chicago, and it offers intensive rehabilitation and outpatient services to adult men, adolescent treatment programs for teens, and a 12-step program available to everyone. Treatment modalities include inpatient, outpatient, telehealth, detox, and sober living, with additional services available including cognitive behavioral therapy (CBT) and 12-step facilitation.

What are the 4 types of drinker?

Generally, people drink to either increase positive emotions or decrease negative ones. This results in all drinking motives falling into one of four categories: enhancement (because it's exciting), coping (to forget about my worries), social (to celebrate), and conformity (to fit in).

Gateway has seen more than 1 million graduates over the last five decades. If you don’t have VA health care benefits, you may still be able to get care. At RCA, we conduct a comprehensive assessment with every patient to create a precision diagnosis and a meaningful, individualized treatment plan that starts at the source.

Tour Our Facility

Lunch is also provided to patients daily who are enrolled in these treatment options at our hospital. If you think you may need rehab, choosing a detox and addiction therapy program is an important first step toward getting help for alcoholism and drug addiction and finding recovery from sober house substance abuse. Though inpatient rehabilitation programs are frequently 28 or 30 days to 90 days long, the first part of all of them is detox. During detoxification, a treatment professional helps you to manage the symptoms of withdrawal that occur when you stop taking drugs or alcohol.